What is A Blockchain? This post is ground zero for understanding the new financial system. But first, let’s try to make sense of the current financial system. Earlier in United States history, paper money as in the US dollar, was pegged to gold. The US Treasury held that gold somewhere in a vault, which made the paper dollar valuable. The Federal Reserve, a banking cartel composed of the most powerful banks in the US, such as Chase Bank and Bank of America, was created in 1913 through the Federal Reserve Act. I suggest you read The Secrets of the Federal Reserve by Eustace Mullins to learn more. Over time, it was given extraordinary control over the US monetary system. The Treasury prints the physical dollars and coins, but it is the Federal Reserve that effectively controls the money supply. It sets interest rates, allows fractional lending practices, and pressures Congress to take major steps, including the historic decision to leave the gold standard. The Federal Reserve did not simply observe as the dollar was untethered from gold — it applied significant influence that ultimately forced the Nixon administration’s hand in the 1970s.

Since the US left the gold standard, the dollar has been tied to the global oil market, earning the name Petrodollar. The US military’s massive global presence exists in large part to ensure that oil is bought and sold in dollars. Any country that threatens to trade oil in another currency has faced immediate intervention. A prime example is Muammar Gaddafi, Libya’s most accomplished leader. Under Gaddafi’s leadership, Libya prospered; citizens were taken care of like never before in its history, while the country became the richest on the African continent. His mistake was attempting to create a gold-backed African currency, similar to the Euro, which would unite African nations. The United States, under President Obama, went to great lengths to destroy Gaddafi. We were told that NATO’s 2011 military intervention was triggered by the uprising during the “Arab Spring” and was the U.N.-authorized “responsibility to protect” mission. A deeper look tells us that was the excuse used to make the invasion seem justified. The once beloved Gaddafi was labeled a terrorist and his popular government systematically destroyed as the US and NATO dropped bombs to “protect democracy.” Under the direction of Hillary Clinton as Secretary of State, the NATO-instigated war paved the way for Gaddafi’s humiliating execution. Fifteen years later, Libya is the failed state you no longer hear about. It is plagued by chaos and even slave trading. For the US, the UN, and NATO, that is not particularly problematic — the African gold‑backed currency that threatened the Petrodollar was the problem. Period.

Since leaving the gold standard, the dollar has lost nearly 99% of its original value. We are in free‑fall inflation due to runaway US debt and unrestricted printing of dollars. Today, the US owes trillions of dollars, and the gross national debt recently surpassed $38 trillion. CRFB+2Joint Economic Committee+2 The yearly interest payment is now one of the largest expenses of the Treasury. The irony of the $38 trillion U.S. debt is that the government owes a huge portion of it to itself—specifically to the Federal Reserve and to U.S. programs like Social Security and Medicare that are forced to lend their surplus back to the government. The rest is held largely by major global central banks (including G10 members), meaning the so-called “debt crisis” is mostly a circular system of institutions lending to one another rather than an external enemy holding America hostage. Nothing US citizens have done caused this; it is entirely the result of Congress acting at the behest of wealthy banking interests. It is not unreasonable to believe that this scenario was designed by the smart bankers running the Federal Reserve. They had to have anticipated or, moreover, orchestrated much of it. Citizens’ buying power has been systematically diminished. Since the implementation of the Federal Reserve, the system has moved pointedly to benefit the financial elite at the top.

Another aspect of this story is the BRICS nations — Brazil, Russia, India, China, and South Africa plus Saudi Arabia, Iran, UAE, Egypt, and Ethiopia. These countries have formed an alliance to challenge the US financial hegemony that restricts oil trade to the Petrodollar. They are promoting trade in local currencies and developing alternative payment systems like BRICS Pay, which could rival the US SWIFT network. SWIFT- Society for Worldwide Interbank Financial Telecommunication – is run by the Bank of Belgium with oversight by the G10 Central Banks including the Federal Reserve, the Rothschild-linked Bank of England and the European Central Bank (ECB), et cetera. SWIFT gives the US power to sanction countries. Blockchain is helping to facilitate the BRICS nations’ move towards independence from SWIFT dominance. In the news, the BRICS nations are portrayed as the adversaries to the Western Block nations. – the supposedly good guys. We are expected to fear the BRICS nations and to cheer SWIFT. However, leaders of all major BRICS nations have been sighted at the World Economic Forum (WEF) events at Davos. Some like Vladimir Putin (Russia), Cyril Ramaphosa (South Africa), Narendra Modi (India), Jair Bolsonaro (Brazil), Xi Jinping (China) have been keynote speakers. In other words, the ruling elite are all linked via the same organization – the WEF. All the world’s a stage!

So who are the global economic decision‑makers? Beyond the Federal Reserve banking cartel and the other SWIFT bankers, there is the WEF, a consortium of the most powerful individuals and organizations in the world, including Big Tech, Big Pharma, Big Banks, Bill Gates, BlackRock, and numerous WEF-trained heads of state. The WEF is the driving force behind the UN’s Agenda 2030. Officially, Agenda 2030 is the UN’s plan to achieve sustainable development by 2030, built on 17 Sustainable Development Goals (SDGs) targeting poverty, inequality, climate change, and environmental protection. It sounds ideal — ending poverty, hunger, providing clean water, education, and gender equality — but the reality is different. This agenda is designed by the wealthiest among us, while the working class and poor have no voice in shaping it. Agenda 2030 also includes developing a digital public infrastructure to require people to prove their identity online in order to access services like financial, health, and social security systems. Central to this vision is digital money. Inflating the Petrodollar into near‑worthlessness is a prerequisite for rolling out the new system of digital IDs and digital dollars. Once inflation destroys traditional purchasing power, people will eagerly accept what seems like a lifeline — the new financial system.

Now we can address the questions: What is the new financial system, and what is blockchain? The new financial system is a future‑oriented ecosystem driven by digital technologies such as tokenized unified ledgers, blockchain, and artificial intelligence. Key components include a single, shared ledger for central bank reserves, commercial bank money, and government bonds. Asset tokenization will represent ownership of physical and digital assets as blockchain tokens, increasing liquidity and enabling fractional ownership. All real estate, for example, will be tokenized. Money will be programmable, allowing transactions to be automated through smart contracts, creating enforceable rules for financial activity. China demonstrates an early example of this, linking digital payments to social credit scores and Digital IDs. Digital payments will replace traditional methods like checks and fiat. Services such as FedNow, which will provide most/all social security and welfare payments in the future, will likely be among the first platforms to implement these digital payments, potentially requiring a Digital ID for participation. The Real ID is a prototype of Digital ID in the US. Integration and interoperability will ensure the new system connects seamlessly with existing financial infrastructure, rather than fully replacing it.

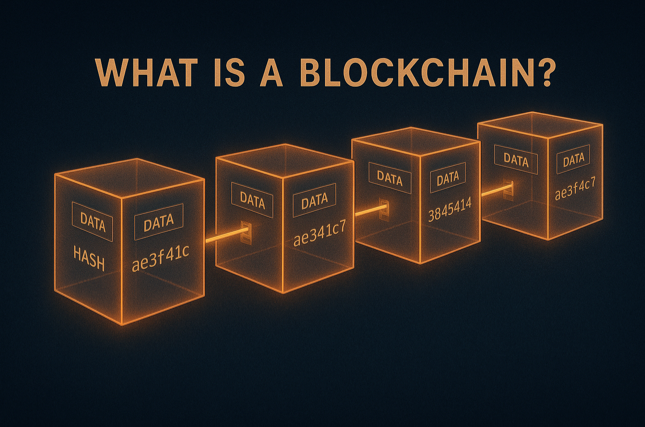

Blockchain will be the rails for this new financial system. A blockchain is easiest to imagine as a long line of connected lockboxes, where each lockbox is called a block and the entire line forms the chain. Each block contains a list of transactions — records of who did what and when — along with a timestamp and a unique digital fingerprint called a hash. Every block also carries the fingerprint of the block before it, linking them together and making the chain unbreakable. If someone attempts to change an old block, its fingerprint changes, breaking the link to the next block, and the network rejects the tampered version. What actually moves from block to block is verified information: new transactions enter the network, computers confirm their validity, and a new block is created, carrying its own fingerprint and the fingerprint of the block before it. This repeating process forms a constantly growing chain of trusted information.

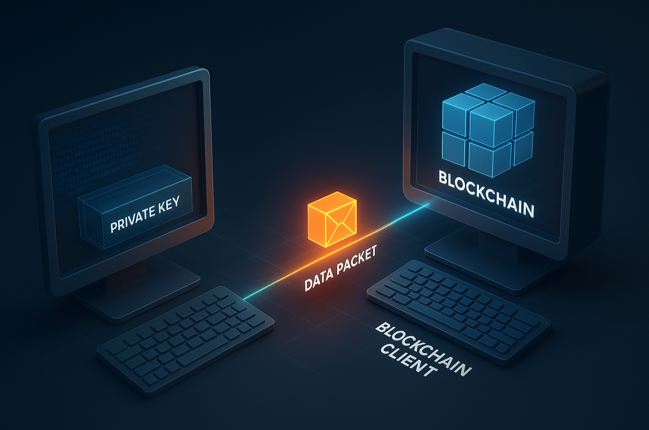

A blockchain does not reside in a single place. Copies exist on thousands of computers called nodes worldwide. Each node stores the chain, preventing any single person or organization from secretly altering history. There is not just one blockchain; there are thousands. Some, like Bitcoin, Ethereum, Solana, and Avalanche blockchains, and the XRP Ledger, are public and open to anyone. Others are private, used within companies or shared among groups of organizations. You can think of them like roads: some are major highways, some are private driveways, and some are specialized routes for particular purposes.

In the simplest terms, a blockchain is a global notebook that nobody owns but everyone can trust. It chains verified blocks of information together in a way that makes the history permanent and nearly impossible to rewrite, allowing people and computers anywhere in the world to agree on what happened, even if they do not know or trust each other personally.

The new financial system is inevitable. The more you learn about it now, the better positioned you will be — not just to survive but to thrive. This isn’t speculation or wishful thinking — this shift is already underway. Those who understand blockchain, digital money, and tokenized assets before the wave breaks will have the advantage. Get educated. Get ahead.

References

U.S. National Debt – US Debt Clock – real-time tracking of US national debt, currently over $38 trillion.CRFB Press Release on $38 Trillion Debt – Committee for a Responsible Federal BudgetBlockchain Basics – Investopedia: Blockchain Explained – a clear primer on blockchain technology.Digital Assets & Tokenization – World Economic Forum: Tokenization of Assets – overview of asset tokenization and blockchain applications.FedNow & Digital Payments – Federal Reserve: FedNow Service – official site on the Fed’s instant payments system.

Leave a Reply